Common Stock vs. Preferred Stock A Guide

Tickers GOOG and GOOGL both represent shares of Alphabet common stock, but they are two distinct share classes that have slightly different prices and attributes. Most publicly traded stocks.

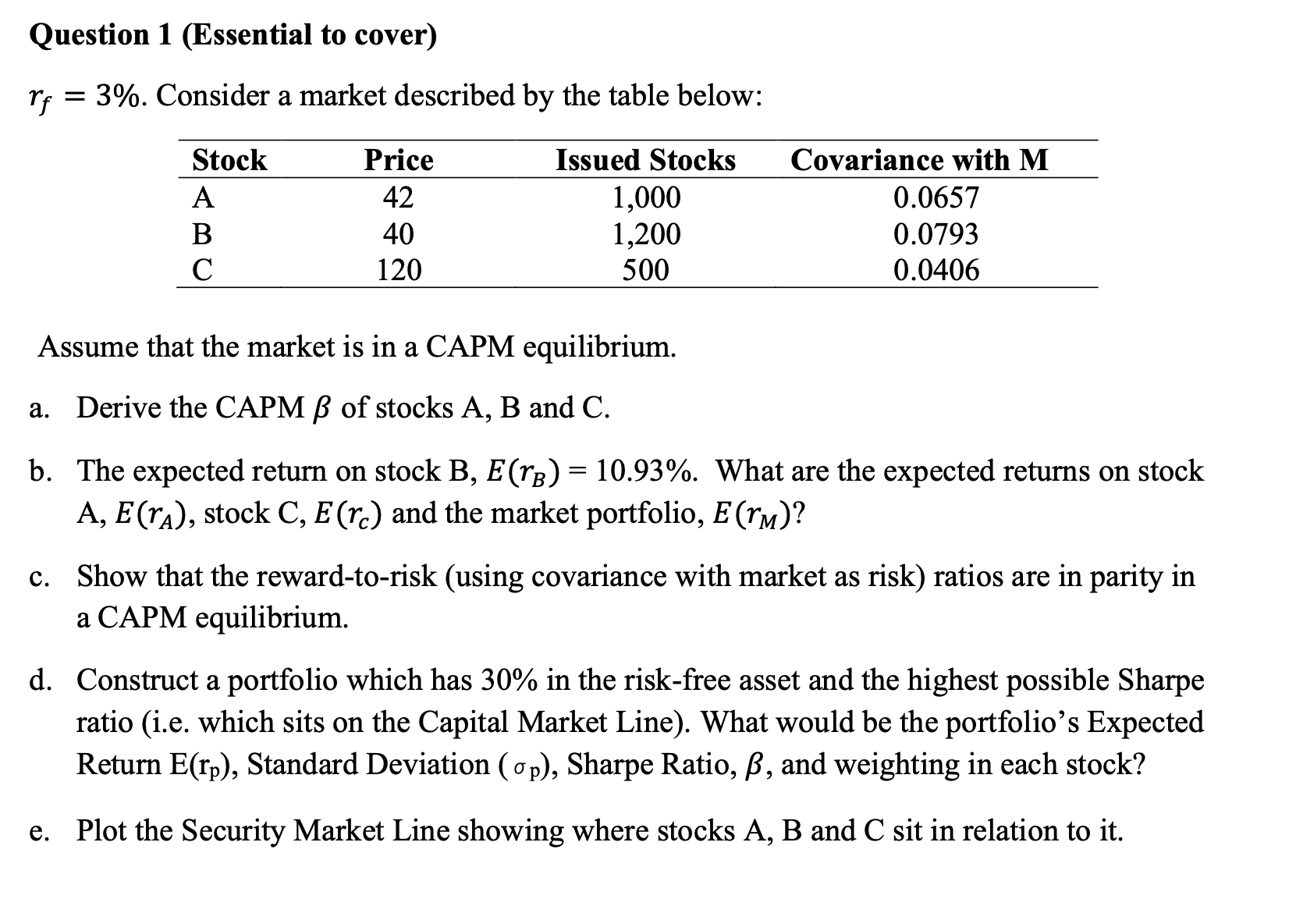

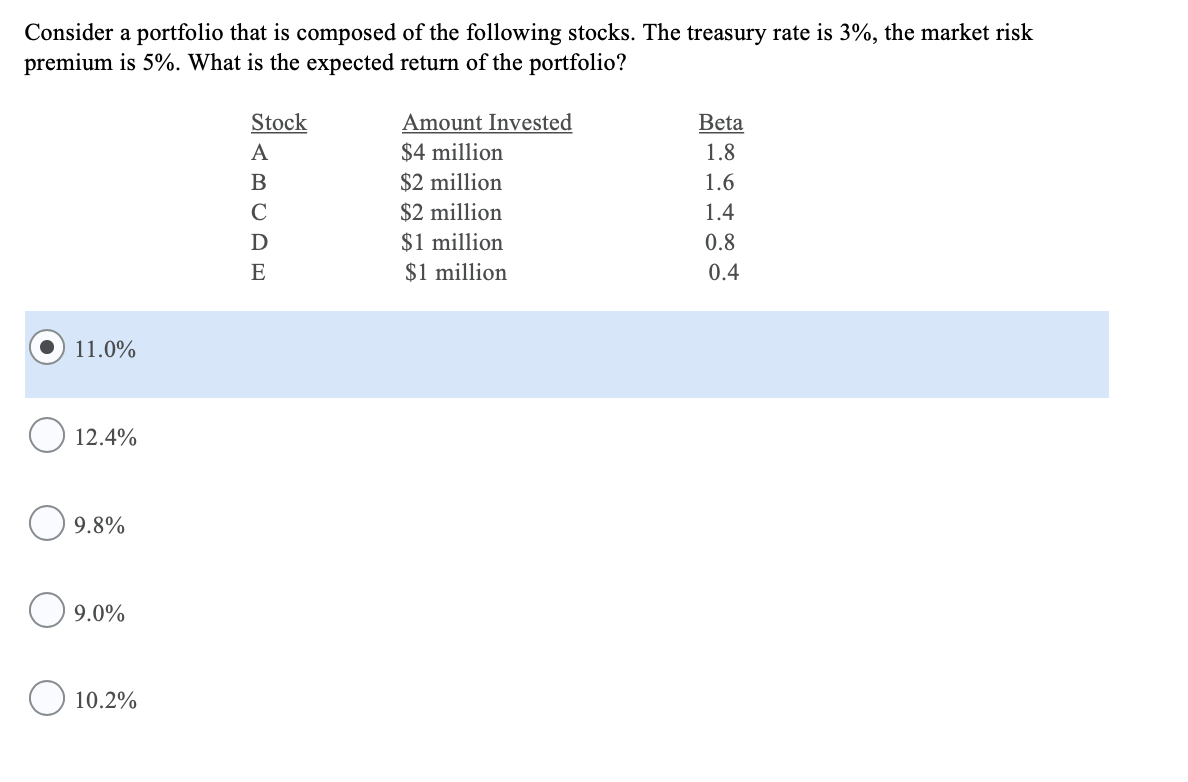

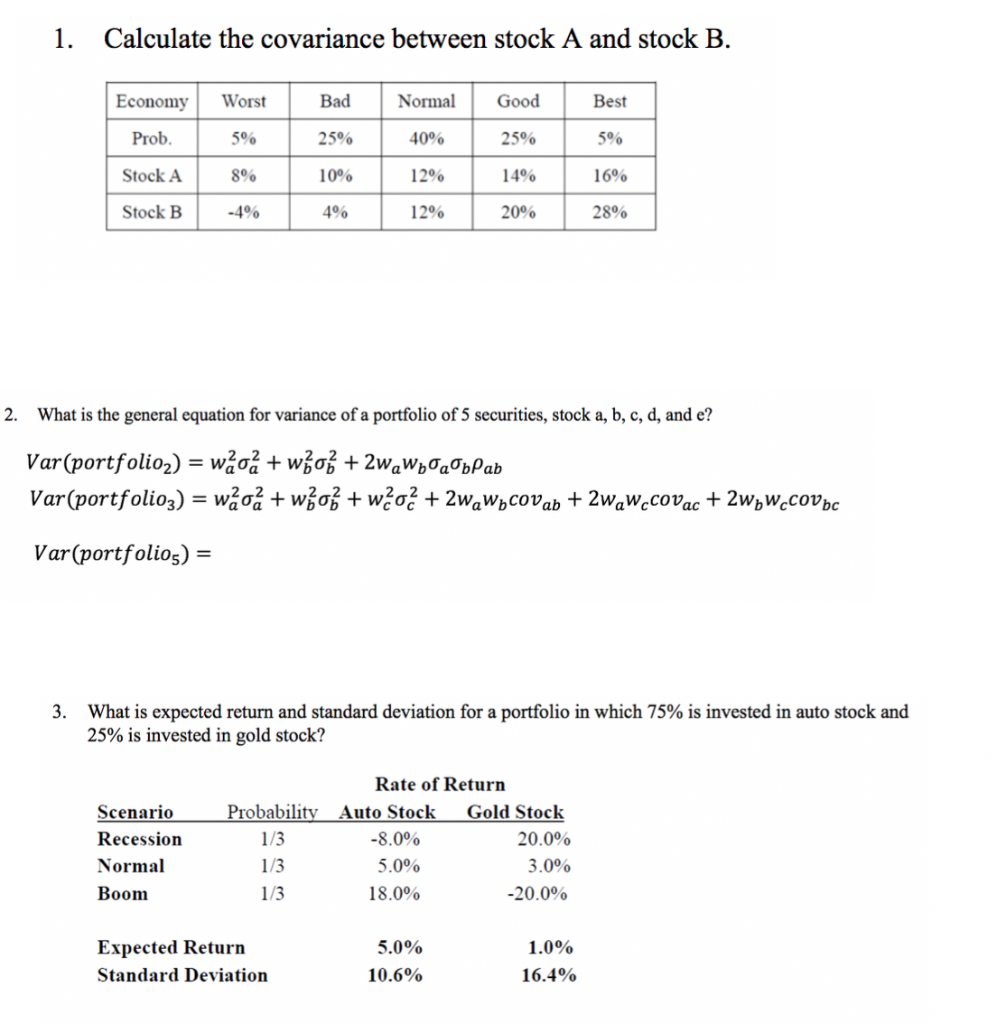

Solved Question 1 (Essential to cover) rf = 3. Consider a

Series A common stock has one vote per share, Series B common stock has ten votes per share and Series C common stock is non-voting stock (subject to certain exceptions in the case of Series C common stock). Series B common stock is exchangeable at any time by the holder on a one-for-one basis for Series A common stock.

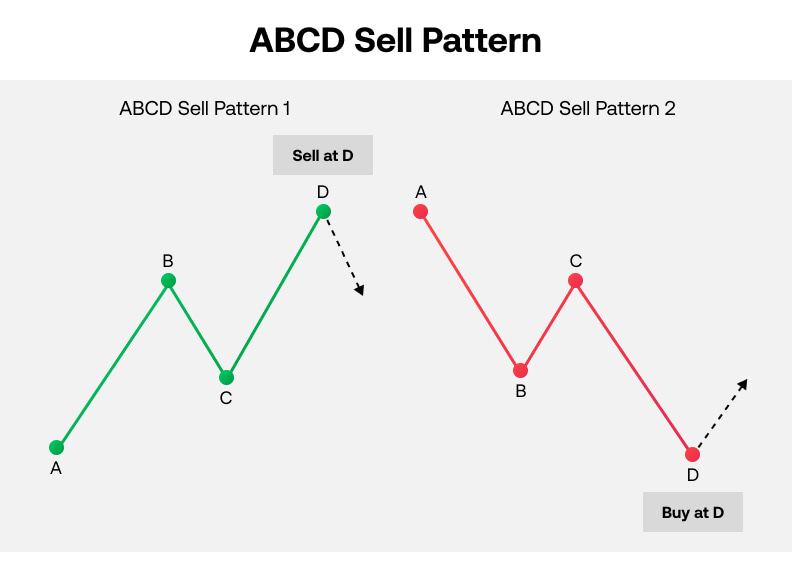

ABCD Pattern Trading What is ABCD Pattern? US

What Is Series A, B, and C Funding? Series A, B, and C are funding rounds that generally follow "seed funding" and "angel investing," providing outside investors the opportunity to.

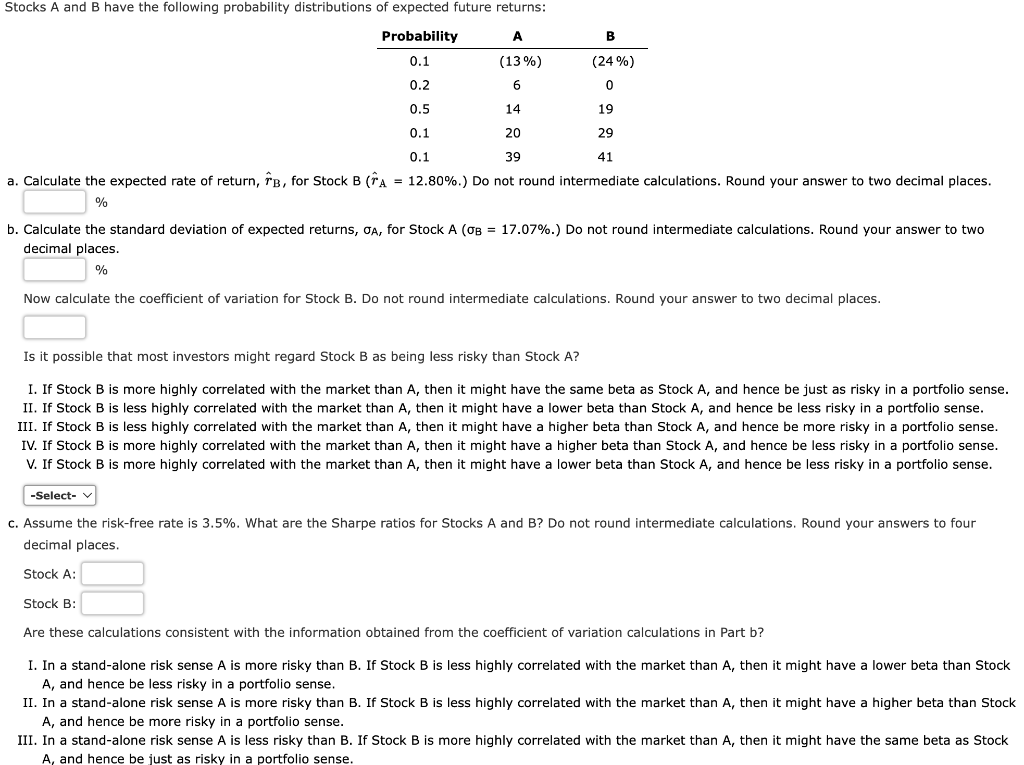

[Solved] Consider the following probability distribution for stocks A and B... Course Hero

Corporate charters - not the law or the courts - define the difference between the classes of stock, often designated as Class A, B and C. Understanding how various classes of stock.

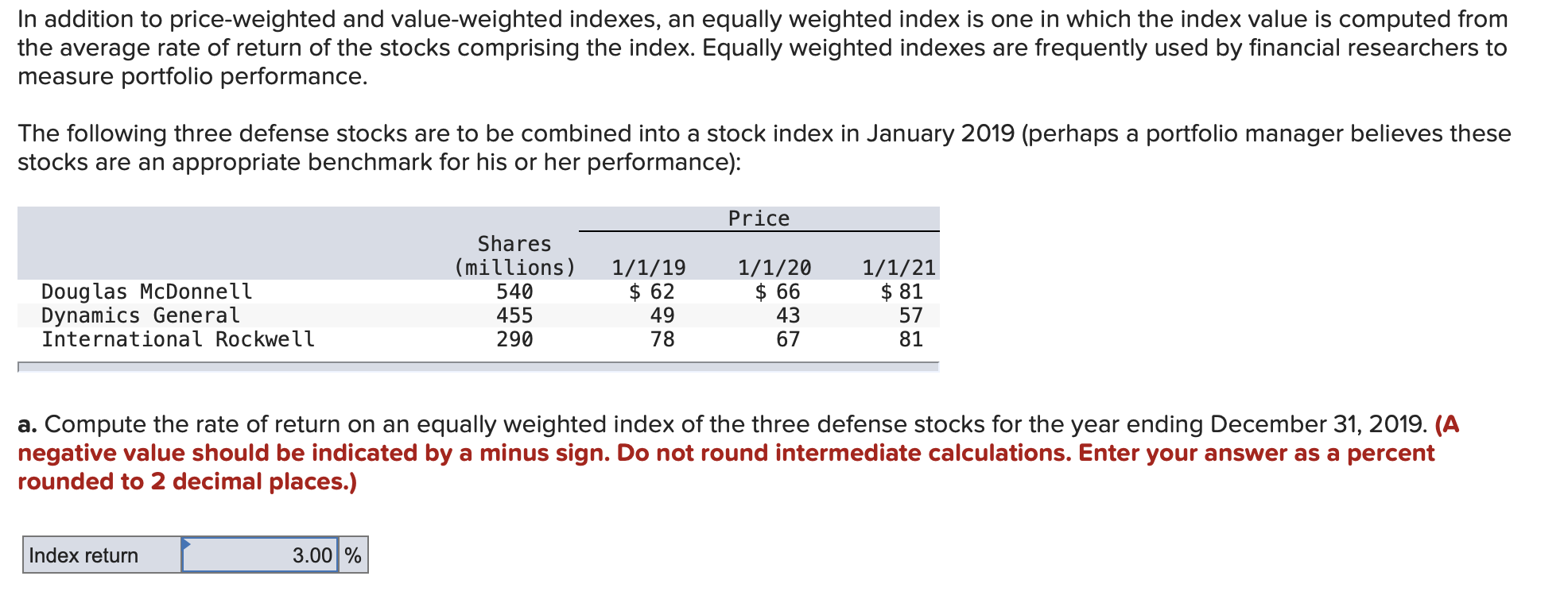

Solved In addition to priceweighted and valueweighted

Google's parent company, Alphabet, announced a 20-for-1 stock split in February 2022. The split took effect on July 15, 2022. GOOG GOOG shares are the company's Class C shares. Class C shares.

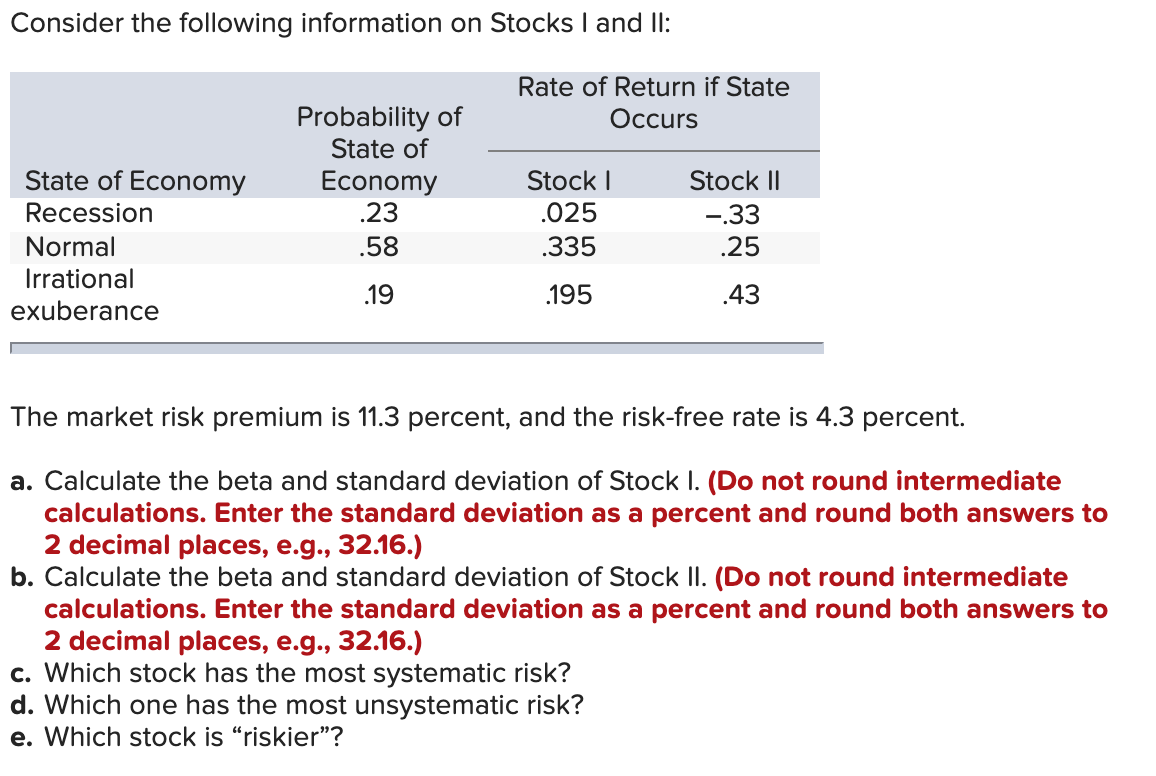

Solved Consider the following information on Stocks I and

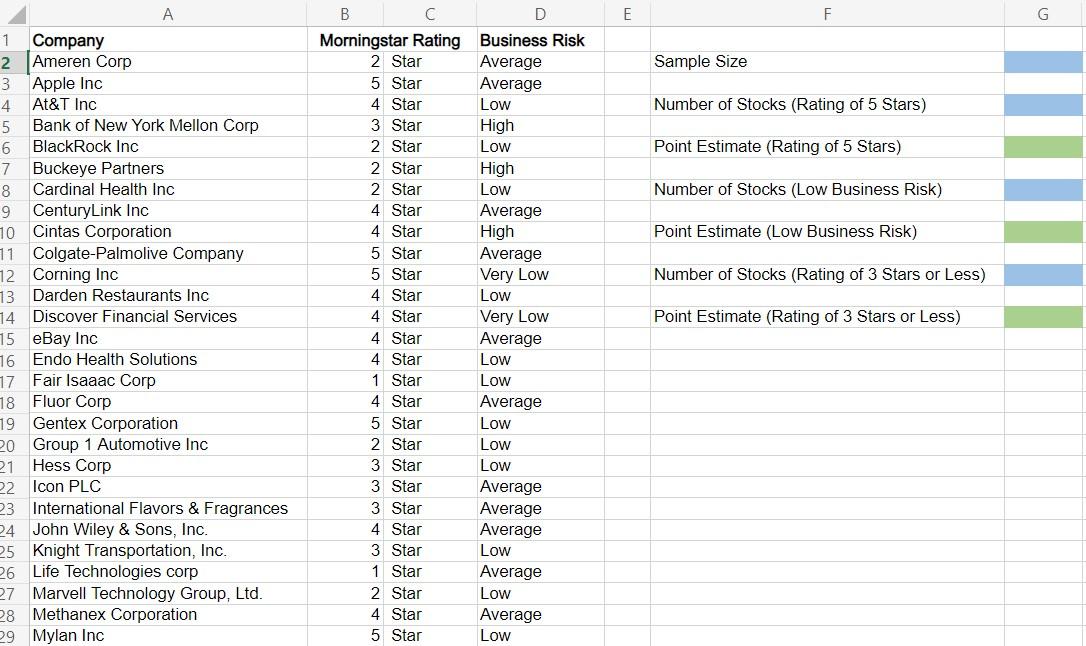

Schwab Equity Ratings Schwab Equity Ratings use a scale of A, B, C, D, and F, and are assigned to approximately 3,000 U.S.-traded stocks. Schwab Equity Ratings use a scale of A, B, C, D, and F, and are assigned to approximately 3,000 U.S.-traded stocks.

:max_bytes(150000):strip_icc()/dotdash_Final_Make_Money_With_the_Fibonacci_ABC_PatternJan_2020-5d08cd44eaea4ae192e08c1f68758b8f.jpg)

Make Money With the Fibonacci ABC Pattern

Class A and B shares are aimed at long-term investors, whereas Class C shares are for beginning investors who aim for short-term gains and may have less money to invest. Class C shares, especially.

Solved Consider a portfolio that is composed of the

The downside is that Class B shares don't have a high control. The voting power and price doesn't necessarily have to be in proportion. For example, Class A shares could cost around $3,000 and receive 100 votes. On the other hand, Class B shares may cost up to $120 with just a single vote.

Solved Stocks A and B have the following probability

Ditto for the B, C, D and F grades. The stocks that's the highest A may look very different than a stocks that is the lowest A (almost a B). Stock selection (even within all the A-rated stocks), how tight you place your stops, when and how you enter the trade will all affect your results.

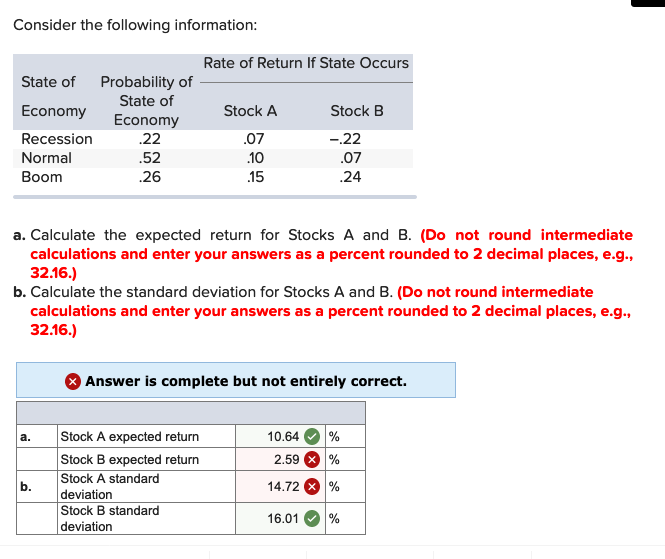

Solved a. Calculate the expected return for Stocks A and B.

A 50-to-1 stock split in 2010 sent the ratio to 1/1,500 th, which means each share of a Class A common stock was convertible at any time to 1,500 shares of Class B common stock.

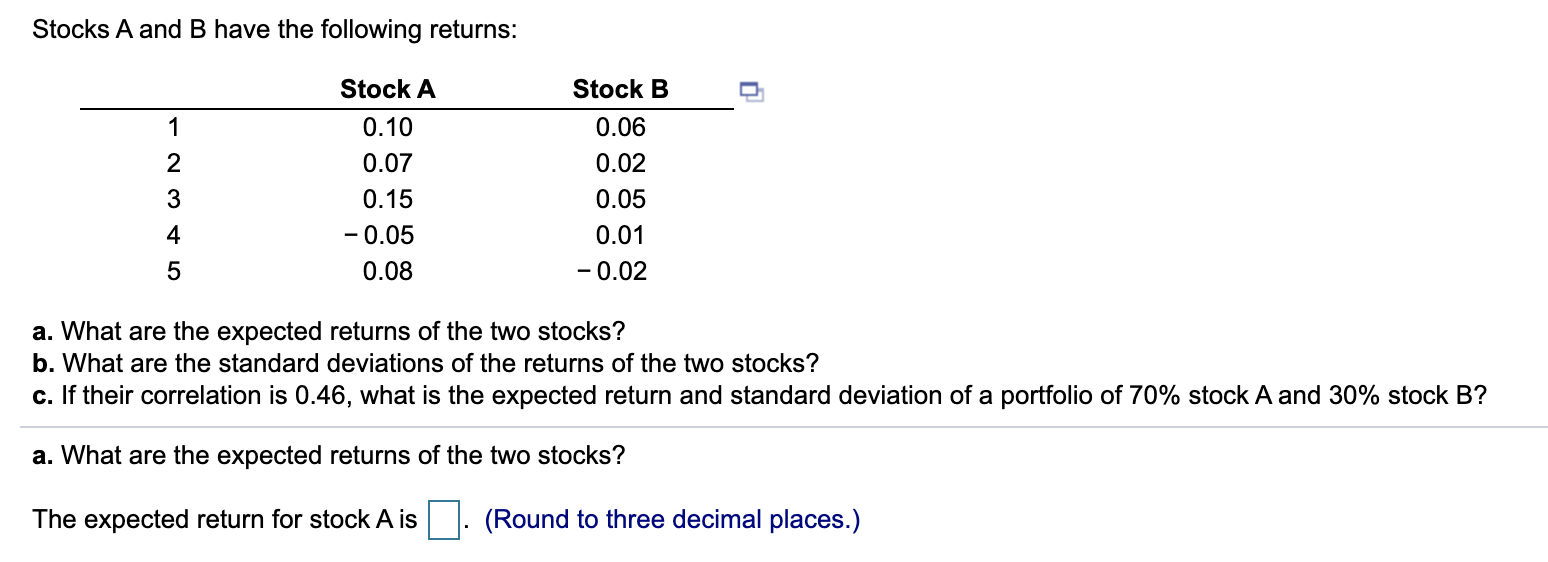

Solved Stocks A and B have the following returns Stock A

• Class C shares can refer to shares given to employees or alternate share classes available to public investors, with varying restrictions and voting rights. Why Companies Have Different Types of Stock Shares When a company goes public, they are selling portions of their company, known as stocks, to shareholders.

Solved Calculate the covariance between stock A and stock B

A letter, followed by the word 'stock', in the 'retail industry', refers to the degree of 'newness' of an inventory or specific product item. Inventory items can be referred to as A, B, C & D-Stock conditions as well as 'Demo', 'Refurb', 'Close-out', 'Overstock', 'Second', 'Blems', 'Factory Overruns', and more.

SOLVEDStandard Deviation and Beta There are two stocks in the market, Stock A and Stock B. The

When a company issues Class A and Class B shares of stock, it can define these shares almost entirely as it pleases. It can give Class B shares three votes each, or it can say that Class A stock receives half of Class B. So long as the definitions do not violate a shareholder's legal rights, the company can set these terms as it pleases.

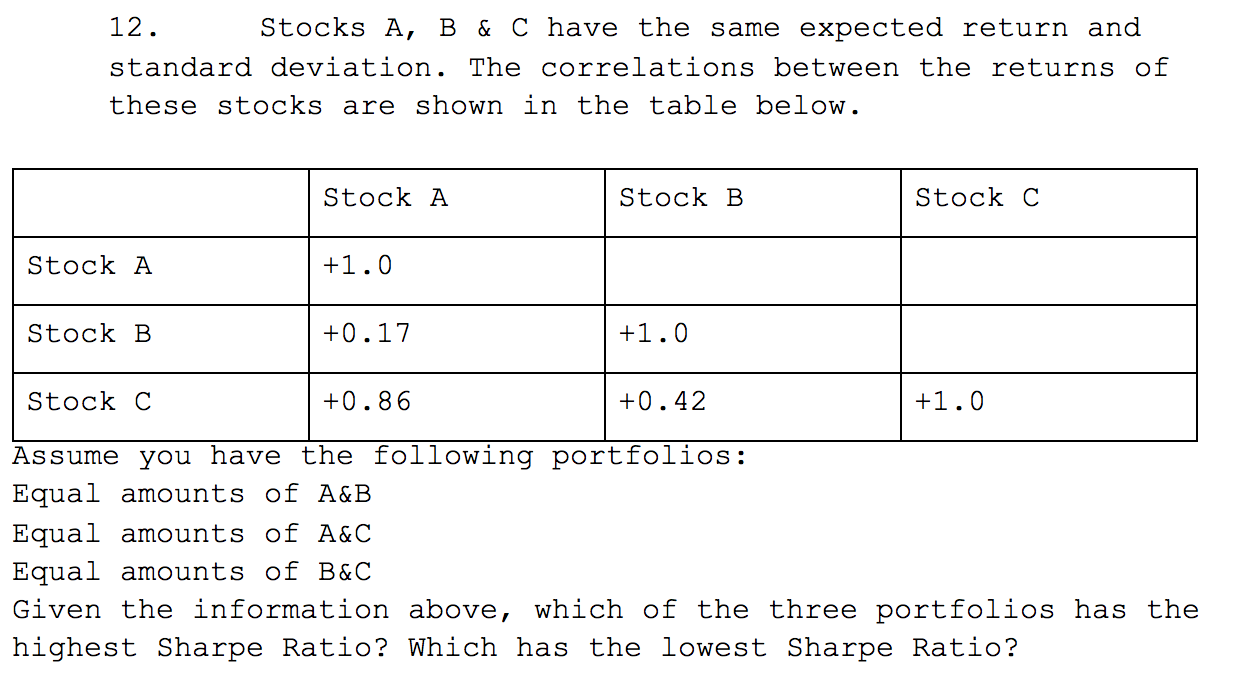

Solved 12. Stocks A, B & C have the same expected return and

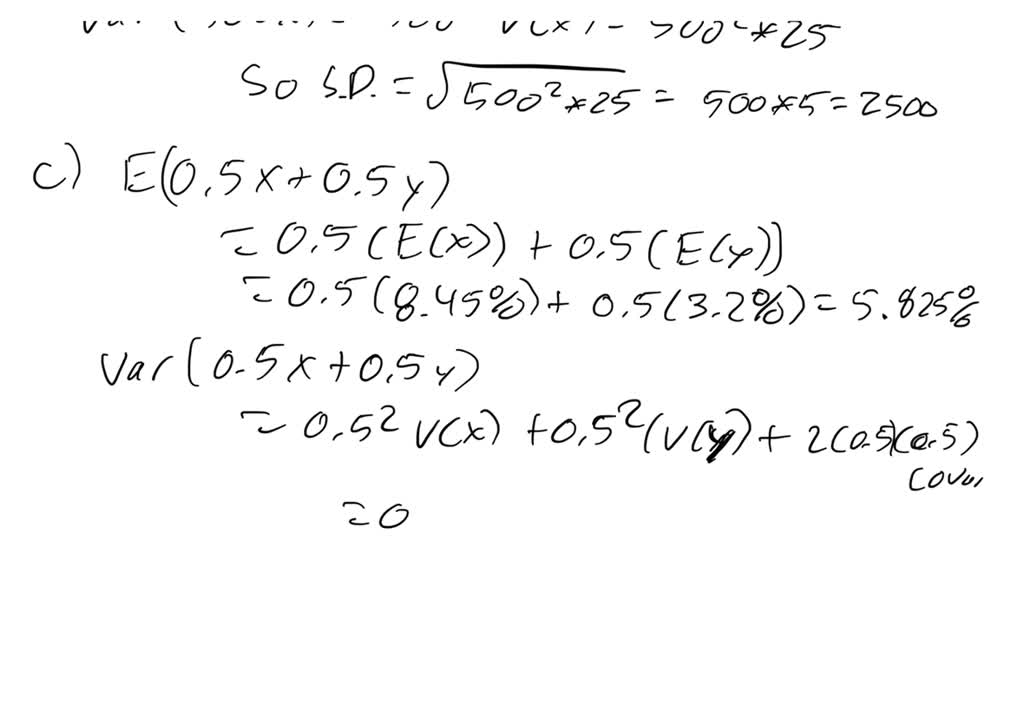

Correlation coefficient shows how much two stock move in relation to each other. The coefficient can have the value in range from -1 to 1. Value of 1 stands for strong positive correlation, where two assets move identically.On the other side, -1 stands for strong negative correlation where two assets move in completely different directions. Value of 0 indicates that two assets are unrelated.

Solved Morningstar publishes information on 1208 company

Class A shares refer to a classification of common stock that was traditionally accompanied by more voting rights than Class B shares. Traditional Class A shares are not sold to the public.

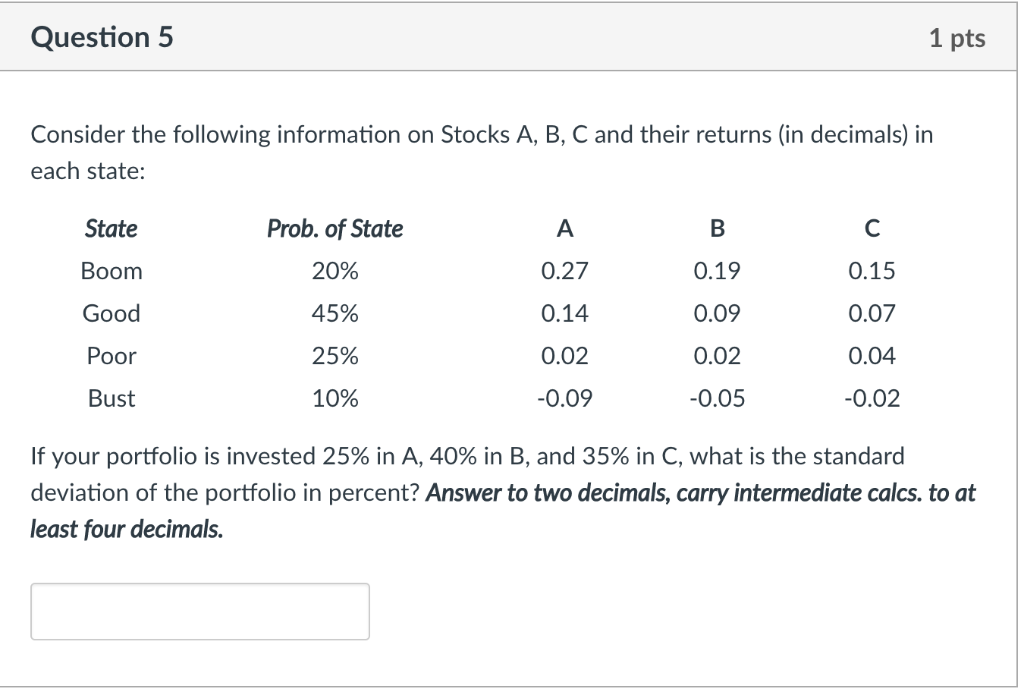

Solved Consider the following information on Stocks A, B, C

Class A Shares vs. Class B Shares: An Overview The difference between Class A shares and Class B shares of a company's stock usually comes down to the number of voting rights assigned to the.